8 Steps to Property Development Success

Property development can be a highly effective way of increasing your wealth and securing your financial future, however whilst property development may look easy – rushing into a development with limited knowledge and experience can be fraught with danger and can result in disastrous outcomes if the development project isn’t planned and executed properly. This article explains some of the critical steps to take and pitfalls to avoid in ensuring that your property development project is successful and profitable.

The recent property booms in Sydney and Melbourne have created thousands of property millionaires. Many homeowners inadvertently benefited from the property boom with their land values increasing significantly as a result of the ‘supply and demand’ phenomenon. Low housing stock levels (supply) and high numbers of buyers (demand) have caused land values to increase, which in turn caused more buyers to enter the market so they could secure their position and ride the wave of increasing property values. The reality of course is that property booms don’t last forever and it is expected that a market correction will occur towards the back end of 2017 and early 2018, where property price increases will slow down and plateau slightly before the next boom cycle.

One of the significant benefits of property development is that this strategic approach enables profit to be ‘manufactured’, regardless of whether land values are increasing and any profit generated as a result of increasing land values can be considered a bonus. That’s not to say that efforts should not be made to conduct research and purchase land in areas with growth potential, as this is the most effective way of optimising your return on investment. The point is, profits can be generated regardless of rising property prices and your project feasibility should stack up financially with the assumption of zero land price growth. This helps to ensure that you do not take on too much risk and put the project in jeopardy by assuming that the land being developed will increase over the duration of the development project.

Below are eight steps that we recommend to ensure that your property development project is profitable and successful:

1. Goals and Objectives

The first step in any property development project is to define your goals and objectives. There are many questions to ask yourself – What are you hoping to achieve from the project? Are you looking to generate cash or equity? Are you planning to build two dwellings, four dwellings, twenty dwellings? Are you planning to sell all of the dwellings upon completion of the project, or will some be retained and tenanted? How much capital are you planning to invest in the development and what is your targeted financial return on that capital? What is the time frame for your project and how long do you expect the development to take? Are you managing and/or investing in the property development yourself or are you teaming up with another investor? Who will design and construct the dwellings for you? Who will be on your team? The list goes on…

2. Ownership Structure

Before embarking on your property development project, it is important that you take the time to discuss your development with an Accountant and Lawyer who specialises in property developments to establish the correct ownership structure. Unfortunately, there is no ‘perfect’ or ‘one size fits all’ structure; however some structures are more appropriate than others from a tax efficiency and asset protection perspective. Selecting the most appropriate ownership structure to achieve your goals and objectives depends predominantly on your personal circumstances and whether or not the properties will be retained or sold upon completion of construction. There are many structures available such as purchasing the property in your own name, within a company, a trust or perhaps you are setting up a joint venture. Each ownership structure comes with it’s own features, advantages and disadvantages, so it is important to understand the pros and cons of each before making a decision.

3. Finance Affordability

The next step is to calculate how much capital you can afford to invest in the development project and your borrowing capacity, which will determine the size of your property development project and the potential areas in which you can afford to build. Most lenders use a system called the ‘5 Cs of Credit’ to ascertain the creditworthiness and associated risk of potential borrowers. The 5 Cs of Credit include Character, Capacity, Capital, Collateral and Conditions, which assist lenders in calculating the risk of lending funds to potential borrowers. There can be many variables and obstacles involved in organising lending for property developments, so it is recommended to engage the assistance of a mortgage broker who specialises in property development to assist you with your lending application. Mortgage brokers do not cost the developer any more than dealing with the lender directly, as the broker is paid a commission by the lender (not the developer). It is important to evaluate the various lenders as their interest rates and terms of business vary significantly.

4. Feasibility Study

Once you have an idea of the size of the development you can afford, it’s time to undertake a feasibility study to ensure that your property development project is viable and profitable. The first step is to produce a short list of potential suburbs (macro-locations) and then drill down into the desirable pockets of each suburb (micro-locations). Ideally, you will be looking for suburbs with growth potential that have not boomed for a few years and have the fundamentals in place to support capital growth such as close proximity to schools, hospitals, employment, transport, infrastructure, shops, restaurants, community hubs and areas where significant investment is occurring. Once you know which areas interest you, you will be able to conduct some market research to investigate recent sales prices for similar dwellings in the various locations, which you can use to help with your feasibility study. The next step is to build a feasibility model, which calculates the expected return on investment for the property development project and includes all of the expected revenue and costs for the project. The figures in the feasibility model should be conservative and a contingency should be included to minimise project risk and protect you against any unexpected events (which occur during most, if not all projects). It is usually a good idea not to allow for any expected land price growth in the local area over the duration of the project to further minimise project risk. It is worth noting however that the land value per square metre at the end of your development project is likely to be higher than it was at the beginning – this is a result of sub-dividing the block and is where much of the profitability for your project will come from. It is also worthwhile arranging for an accountant check your feasibility study to ensure that the calculations and tax assumptions are correct, as these can vary depending on the type of project and ownership structure.

5. Purchase Land

With your feasibility study completed, it’s time to find and purchase a suitable development site. Once you have found your micro-location (see Feasibility Study section above), it’s time to start narrowing your search to identify potentially suitable property development sites that meet your budget, goals and objectives. It is imperative that the necessary due diligence is undertaken prior to purchase to ensure that there are no obstacles that may derail your project or prevent the development from being approved by council (such as heritage overlays, vegetation overlays, planning restrictions, easements, covenants, minimum lot sizes, private open space restrictions etc.). You should arrange for your conveyancer and town planner to check over the Section 32 Statement to alert you to any potential risks prior to purchase, as well as engaging your builder to assess the site to advise you of any potential issues that may increase cost or constructability such as site slope, access, obstructions etc. You will need to ensure that you understand the local council’s property development policy to determine how many dwellings can be constructed on the site. This can vary from council to council and even within different areas within the same municipality. You should also conduct market research in the area to ensure that there is demand for the type of dwelling that you are proposing to construct. This can be achieved by talking to local real estate agents to get their perspective on the current and expected future market conditions. Real estate agents can also provide you with expected selling and rental prices, which will assist you with your feasibility study and decision making. Before purchasing the site, you should obtain lending pre-approval, which will require you to submit your detailed feasibility study to your lender. The suburb in which you are planning to develop should have good access to infrastructure, transport and should demonstrate strong buyer demand, as this will increase your chance of success with your lending. Once you have lending pre-approval, you are comfortable with your feasibility study and have conducted your due diligence; you are now in a position to purchase your property development site. Remember not to get carried away at auction and purchase the site for more than the maximum amount detailed in your feasibility study, as this will erode the project’s profit and may put the project at risk. Wherever possible, aim to negotiate favourable settlement terms prior to auction such as a delayed settlement (e.g. 180 days) – this will reduce holding costs while you are undertaking the design, town planning and permits, which generally takes approximately nine months.

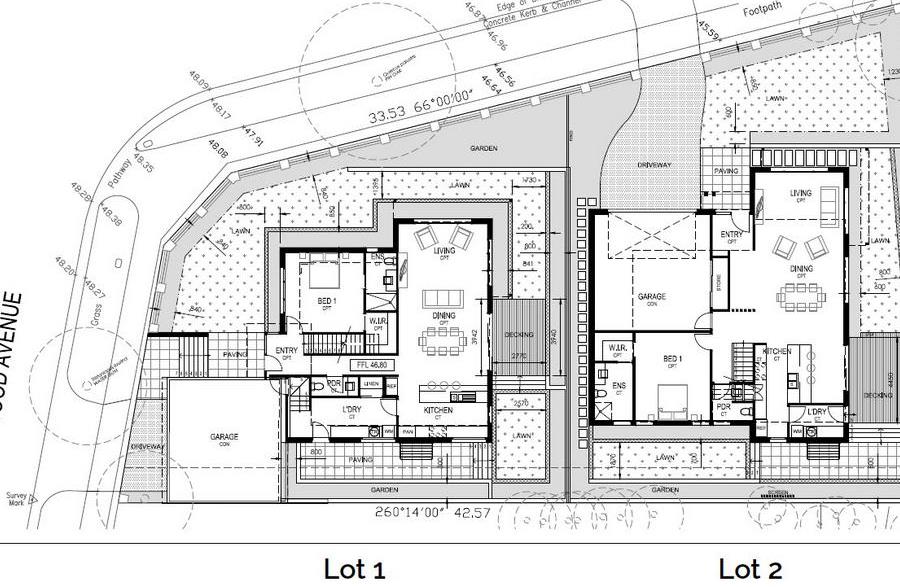

6. Design, Town Planning and Permits

As soon as you have purchased your development site; it is important to quickly engage your custom builder to commence the design of your property development project, proceed with town planning and council planning permit application. Engaging a custom builder (rather than an architect directly) is important as many architects fail to consider their clients’ budget or the cost of their ‘creative’ designs, which can lead to lots of wasted time, cost and heart-ache. Construction costs can quickly escalate, putting the project’s profitability at risk. Custom builders usually have their own architect and design team, which enables them to tightly manage the design process to meet your requirements without over-capitalising on your investment. Generally, the design, town planning and permits process entails the following three phases:

Stage 1: Pre-Application Phase

- Site feature survey including contour levels

- Preliminary planning

- Design development

Stage 2: Preparation and Lodgement of Planning Permit Application

- Planning set of drawings

- Town planning

- Landscape plan (if required)

- Arborist report (if required)

Stage 3: Preparation of Construction Documentation

- Working drawings

- Engineering design an computations

- Civil design

- Soil testing

- Energy rating

7. Construction

Now comes the exciting part where all your plans and preparations on paper turn into reality. The first step is to engage your custom builder and enter into a building contract for the construction of your dwellings (and potentially for external works such as landscaping, driveways, fencing etc.). The construction process generally takes between 7-12 months, depending on project size and complexity. Payments to your builder will be made in stages and will generally be in accordance with the following standard terms: 5% Deposit, 10% at Base Stage, 15% at Frame Stage, 35% at Lock-up Stage, 25% at Fixing Stage and 10% at Completion. It is imperative to select your builder very carefully, as there are many pitfalls to avoid to ensure that your project is delivered successfully. Some builders deliberately under-quote projects with vague contract inclusions in order to win the job and then submit expensive variations along the way in order to bolster their margins. This can often result in you paying more than you budgeted for, which can place your project at risk. Good builders will be transparent and will take the time up front to develop comprehensive and detailed contract specifications and ensure that you understand exactly what is included and excluded from the contract before you sign with them. Pay close attention to contract inclusions and exclusions to ensure that you don’t encounter any nasty surprises along the way that erode your project’s profitability. Quality and price are other important attribute to consider – saving a few Dollars by selecting the “cheapest” builder may seem like a logical idea at the time, however this can often be fraught with danger as “cheap” builders generally utilise low-grade materials and employ low-grade trades people who may cut corners in order to get the job done quickly. This can ultimately result in a poor quality build, defects, re-work, delays and project cost blowouts. As the sayings go: “you get what you pay for” and “price is what you pay – value is what you get!”. It is also important to remember that quality is usually important to prospective buyers, so cheap selections and poor quality workmanship can have a negative impact on your project returns as your dwellings may not sell or may be worth less that originally forecast at completion.

8. Completion

Once construction is completed, a plan of subdivision is finalised and the dwellings are either sold or re-financed, leased and held for the long term (depending on your goals and objectives). With the profit or equity generated from the property development project, many developers ‘lather, rinse and repeat’ by re-investing in their next development project and continue towards achieving their financial goals and objectives.

Are you considering a property development project?

The team at Gentify specialise in property development projects and can manage and build the entire project with you, or on your behalf.

Whether you already have your plans and permits or need an experienced and professional builder to help guide you through the process; the friendly team at ARCA are happy to help, so call us now on 1800 GENTRIFY or email us at enquiries@gentrify.com.au.

Disclaimer: The contents and information contained in this article are intended for general purposes only and should not be relied upon by any person as being complete or accurate. ARCA Pty Ltd, its employees, agents and other representatives will not accept any liability suffered or incurred by any person arising out of or in connection with any reliance on the content or of information contained in this article. This limitation applies to loss or damage of any kind, including but not limited to, compensatory, direct, indirect or consequential damage, loss of income or profit, loss of or damage to property and claims by any third party.